In the last two decades, investments made in digitalization and transaction automation have enabled organizations to evolve significantly in their ability to capture raw customer behaviour data. This combined with massive increase in computing power and data storage has fuelled the growth of analytics industry, now worth more than $50 billion globally.

However, we find that the adoption of analytics is less significant in emerging markets of South Asia, Middle East and Africa compared to the more mature markets of North America and Western Europe. This article presents some key findings of a survey done by dun & bradstreet to assess the adoption of analytics in emerging markets and the emerging trends.

Dun & Bradstreet Survey

Dun & Bradstreet had carried out a survey to assess the usage of analytics in the banking industry as banks have traditionally been the biggest user of analytics. The survey team contacted business and technology decision makers across 250 banks and received 119 responses. Given below are some of the key findings:

Adoption of predictive analytics is low

Adoption of predictive analytics is low

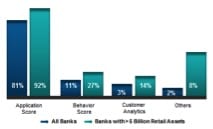

Only one third of the banks confirmed using predictive analytics in their organization. Even among the large banks (> $ 5 billion assets), the adoption rate is less than 50%. In absence of analytical models, most of the banks use well-defined business rules for making lending decisions. Also, this is main form of decision in Islamic banking compared to traditional banking.

Analytics usage is limited to very few areas

Analytics usage is limited to very few areas

Banks are using analytics in very limited areas with main focus on meeting regulatory requirement and risk management. The use of analytics for the purpose of marketing, pricing, customer loyalty and profitability management is very minimal and practiced by few very large banks only. Investments in social media and web analytics are at a very nascent stage.

Nearly half of the banks not using analytics cited “insufficient data” as the primary reason. This is largely due to lack of maturity in IT systems to store historical information in digital format, while one third of the banks are satisfied with current process of relying on business rules instead of analytics. However, most of the banks believe that the adoption will increase in next 2 years with recent investments in transaction automation and data warehousing solutions.

Analytics journey has just begun in these markets

Analytics journey has just begun in these markets

More than 80% of the banks using predictive analytical models in their business decision making process reported that these models were developed within last two years. The main drivers for analytics were stricter compliance requirement from central banks, growing uncertainty in financial markets and need for deploying capital more efficiently. However, banks reported that analytics has also helped them in improving speed and accuracy in their lending decisions.

Reliance on third party service providers

Reliance on third party service providers

Majority of banks have partnered with third party service providers for development of analytics solutions instead of building in-house analytics teams. The key reasons are readily available analytics talent, existing infrastructure of service providers and their experience in developing similar solutions for other markets. However, the large banks have either already invested or plan to invest in building in house analytics infrastructure and capability.

Does it pay to invest in analytics?

As part of this study, dun & bradstreet also c ompared the performance of analytical models with commonly used business rules in taking credit decisions. It was found that analytical models outperformed the best business rules by 24% in their ability to predict credit worthiness of a new customer. In a specific case study, the analytical models delivered an increase of 8% in approval rates with a decline of 1.1% in customer delinquencies adding around $ 10 million on a portfolio of $ 1 billion.

ompared the performance of analytical models with commonly used business rules in taking credit decisions. It was found that analytical models outperformed the best business rules by 24% in their ability to predict credit worthiness of a new customer. In a specific case study, the analytical models delivered an increase of 8% in approval rates with a decline of 1.1% in customer delinquencies adding around $ 10 million on a portfolio of $ 1 billion.

Summing Up

It is evident that currently the adoption of analytics, both in terms of width and depth is fairly limited in the emerging markets compared to the mature markets. Availability of sufficient data of acceptable quality and appetite for investments in analytics infrastructure have been the traditional hurdles. However the investments made in core transactional systems and customer management channels are producing a lot of data about customer behaviour and preferences, which can be leveraged by organizations to understand consumer needs and customize their product and service offerings accordingly to enhance customer experience and loyalty, while mitigating risk. Substantial reduction in data storage costs and analytics tool and technologies has also made development and implementation of analytics solutions more affordable.

Though we still witness some reluctance in using analytics instead of business rules or manual judgement in customer decisions, especially in the higher levels of management. This may be because a generation ago most organizations lived in a data starved environment which resulted in most successful managers of the time relying on experience and intuition to take decisions. We believe that this is likely to change as they start realizing the benefits on their initial investment in analytics to justify higher investments for greater adoption. The use of analytics in emerging market has just begun and we see tremendous growth opportunities in these markets.

The post Analytics usage in emerging markets appeared first on Analytics India Magazine.